Pre-owned Condominium Market

Market Potential

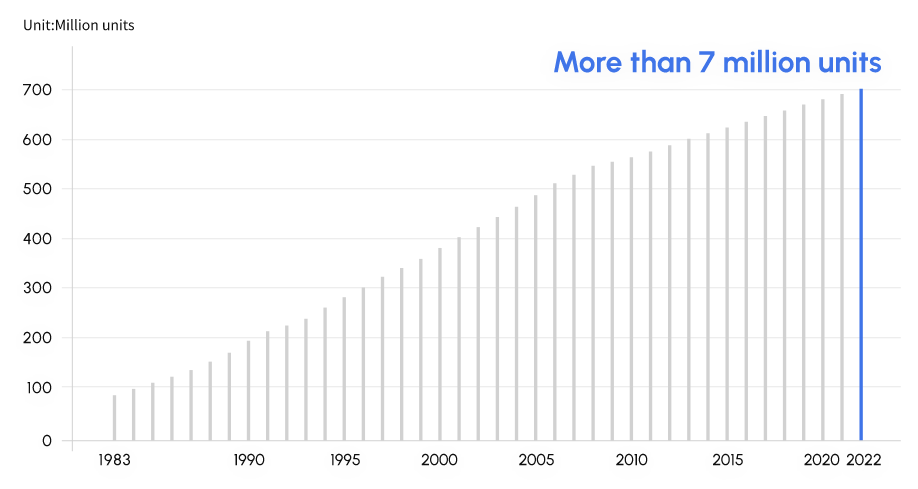

Currently, Japan already has a huge condominium stock of over 6 million units. MLIT is continuously discussing how to effectively utilize the existing the condominium stock and stimulate pre-owned house transactions.

In Japan, facing on declining and aging population, distribution of pre-owned houses will become increasingly important. Therefore, we anticipate pre-owned condominium market will continue to expand.

# of new condominium development

Building structure = SRC, RC, and Steel-frame

Building type = apartment building

Building use = for sale

Japanese Existing Home Market (still developing)

According to MLIT statistics, secondary real estate share is only 14.5% of Japanese house transactions, far behind the U.S. and European countries.

In order to preserve the environment, Japanese government is working on stimulating the distribution of existing houses through various policies such as tax incentives and legislation. We anticipate existing home market will continue to expand.

Secondary Real Estate Share

Our Solutions for Social Issues

Through our business, we provide solutions for social issues in Japan.

Demographic Change

- Increase in the Number of Households due to the Shift to Nuclear Families

- Along with the declining and aging population, the number of “nuclear family” is increasing, therefore, the number of households wishing to purchase houses is expected to increase. Renovated condominiums of 60 to 70 square meters, which we mainly supply, can meet the needs of those households.

Low Economic Growth

- Increased Demand for Reasonable Priced Properties

- Japanese economy is maturing. Over the past decade, average household income has not significantly changed. Meanwhile, the price of new houses has risen dramatically. The households wishing to purchase houses have been facing on the situation of “wanting housing but not being able to afford it”, especially in urban areas. Therefore, the need for a renovated condominiums which are supplied at reasonable price is further increasing.

Acceleration of the Shift to Proximity to Work and Home

- Increase of Need for Houses Located in Easily Accessible Areas

- As awareness of labor efficiency rises in “work style reforms” and the rapid evolution of information technology, more and more households are seeking to live closer to their workplaces. Even today, the hybrid work style with “work from home” and “commuting” is becoming mainstream due to the expansion of COVID-19, the trend toward proximity to work and home continues, and the need to purchase houses in urban areas is increasing in each major city in Japan. We meet this demand by supplying renovated condominiums in easily accessible areas.

Natural Disaster Risk

- Rising Desire for Safety and Security after Major Earthquake

- Japanese houses have faced the danger of natural disasters such as earthquakes and typhoons. Particularly since the Great East Japan Earthquake, most people are focusing on “safety and security”. While some people are concerned about the earthquake resistance of existing houses, we strive to supply highly safe properties by checking repairs and management systems from a professional perspective.